If you were to work for 50 years of your life and then consolidate all your earnings in your entire life just to see if you’ll be able to earn a million dollars, you would be able to achieve it with an average income of $20,000 per year, even without investing. As you can see, that is an easy sum to achieve with an annual income of $40,000 if you save 50% of your pay.

In fact, you might already know a millionaire in your social circle. Man, I wouldn’t even be surprised if you are already one yourself.

But really, do you want to work for 50 years of your life?

I would! But on different circumstances from now, of course. I would love to be able to have the opportunity to work for love, and not for money.

Yes, there are many reason why I can’t do it now, and these reasons may also hold true for you. But it doesn’t mean that we can’t be there any time in the future. All we need is just some guidance and learn how to make our money work for us. Hopefully, it works hard enough to sustain our lifestyle so that we can continue on to pursue other events that may seem more fulfilling to us. And hopefully too, these events may also possibly be able to generate income.

So I would like to think that being a millionaire is not difficult for the average working society. The real question that we should ask is how fast one can be a millionaire.

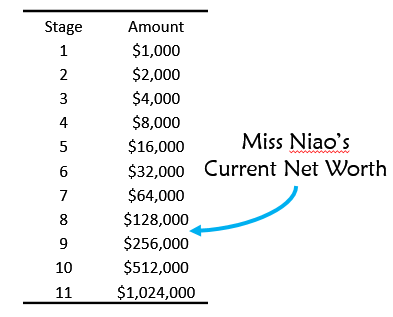

I chanced upon the concept of how money is a doubling game, and it allowed me to view money in a very simplistic way. Let’s see how $1000 can be developed into the wonderful million with just 11 steps.

Now, the idea is this. If you’ve made $1000 this year, would you know what it takes to make $2000 next year?

If your answer is yes, then you’ll practically breeze through Stage 2 and land yourself a sweet spot between Stages 2 and 3 at the end of next year. Or you could be a smart kid and go through multiple stages within a year.

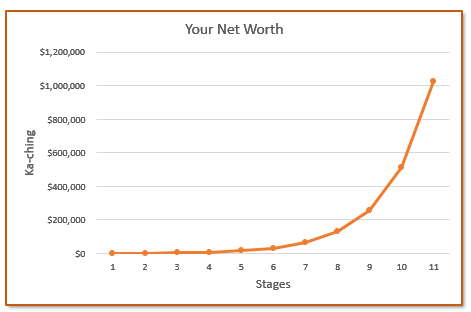

As you proceed up the first few stages quickly, you would also see your net worth increasing as you go along and the graph grows exponentially, similarly to how compound interest would work for your investments.

Bringing myself now into the picture, you can see that my net worth is currently in between Stages 8 and 9. So to speak, I’m actually only 3 stages away to doubling my money and becoming a millionaire. :O

Okay, let’s get more realistic. When the graph grows much more than how it was supposed to in the first few stages, things get a little bit tougher. My incoming cash flow is kinda stagnant since my income is kinda predictable and wouldn’t grow like crazy overnight. I would definitely need to minimize my expenses to increase my savings rate and also find other ways to increase my income.

So I’m at the part of the graph where I gotta be creative with making money, and it might not take me only 1 year to move up the next stage anymore. By using this model, I can perform some assumptions and predict the amount of time that I would need to reach Stage 11 and finally become a millionaire.

What would be my predicted time period for me to be worth a million bucks, then?

The answer lies in my personal cash flow. Assuming that my annual income stays the same and my expenses are around $20,000 a year, it would take me roughly 12-13 years with a 4% yield for my net worth to reach that million.

Doesn’t sound too far off now, does it?

Although I’ve used the doubling effect against my net worth, but you could also apply the same doubling effect to many other things. For example, you could substitute your net worth with your total earnings for that year. Or if you’re running a business, you could use it to estimate how your business would grow to reach the next milestone.

P.S. The calculations are similar to the spreadsheet in this blog post: Passive income of $3000 per month – How did I arrive at this number?

Thanks for reading!

Miss Niao xoxo

Hi missniao,

Rate of doubling slows down as your portfolio grows bigger. When you had $20k net worth and saved $20k the following year, you doubled your net worth in a year. You would need 2 years to double the $40k net worth assuming the same savings every year.

With a bit of luck in investment and/or job advancement, the doubling can be shorter than 2 years. But the doubling rate will still generally take longer as your net worth gets larger. This is more pronounced when your portfolio becomes more diversified.

Having $100k before 30 is a great achievement nonetheless.

Congrats and persevere in your wealth building. You are on the right track.

Regards,

Matthew

LikeLiked by 1 person

Hello Matthew,

Thanks for your valuable insight once again.

Yes, it gets tougher at the higher stages. I’m not sure if you noticed but my calculations for the first part of the post are not related to the “doubling effect” and are more linearly inclined instead. :p

It’s gonna be at least a 13 year journey for me – probably longer if financial commitments increase along the way.

Take note that it’s my entire net worth!!!! Actual savings are much lesser. 😛

LikeLike

Hi MissNiao,

One way is to keep your commitment low. Try to avoid debt as far as possible.

Ben

LikeLike

Very good advice! But there are just some commitments that you can’t escape from. I have never been in debt and never intend to either unless it’s for a greater cause and with good leverage (e.g. property). But those are plans for the future!

LikeLike

Hi Miss Niao,

I’m consoled to see that I’m actually moving towards the 4th stage. This means that I have 7 more stages to go!! However, the inverted pyramid of wealth suggests that it is harder and harder to “level up”. Shall target to reach stage 5 by next year 🙂

LikeLiked by 1 person

Hello Sleepydevil!

Am an avid reader of your blog, its admirable that you are so future-oriented at your age. Being in stage 4 now is already a huge step, press on! Ill continue to ‘level up’ as well 🙂

LikeLike

Hi theheartlandboy,

Thank you for constantly dropping by my blog 🙂 I’ve went to your blog. You’re impressive 🙂

I believe we will continue to march towards financial freedom together 🙂

LikeLiked by 1 person

Thank you as well! I really like the mindset you have when it comes to your financials, though we are 2 years apart in age, your mentality might just be more mature then mine 😁 yes lets strive hard together!

I’ve just added a post on my portfolio and financial situation a minute ago, should you have spare time, please do take a look. Would appreciate any comments or feedback from you 🙂

LikeLike

Yeap! Don’t worry. At your young age, you still have tons of time to catch up. 🙂

LikeLike

Hi Miss Niao,

Thanks 🙂 Let’s work hard together towards our goals

LikeLike

Being in between Stages 8 and 9 is good progress at your age. Just be careful of significant expenses in the future such as wedding, housing, moving out for the first time, kids, etc. They can cause you to get stuck at a certain stage for a while since it’s difficult to save as much when your spending goes up. Unless your income increases at the same pace. Well done anyway!

LikeLiked by 1 person

Yes! Therefore it is highly unlikely that I would be able to achieve the million in 13 years time. I’ll continue to work hard for my personal financial goals for now! 😉

LikeLike

Totally agree. I am 28 this year, married with 2 kids.

Because of the kiddos, need to hire helper since both my wife and I are working. To make life just a little easier, we also drive.

My savings have sort of stagnated already. Can’t save much at all.

Unless one can substantially increase his/her earning ability, there will come a time when growing one’s account becomes much, much tougher.

Maybe that is why many choose not to have children..

My savings have sort of stagnated already. Can’t save much at all.

Unless one can substantially increase his/her earning ability, there will come a time when growing one’s account becomes much, much tougher.

Maybe that is why many choose not to have children..

LikeLike

Please don’t have such a thought! Although I do not have kids of my own, but I think they bring a different kind of joy that money cannot buy. Yes, money is important, but seeing them as a financial burden would not be how I would want to choose to see them. This is also why I am working hard now so that I can be prepared financially when I have kids.

There are many other ways that you can save money and reduce your expenses even with children. I’m sure you can find some answers here and in other finance blogs where the bloggers have kids themselves (e.g. 3Fs written by another Brian). 🙂

LikeLike

Not yet 30 but already over the 100K mark! Kudos to you, do you happen to know what stage you were at when you were 21 years old?

LikeLiked by 1 person

Hello! I actually only graduated 4 years ago with $5000 in my bank account, and that is probably my net worth at that time too. My wealth started to increase a lot more once I started working.

LikeLiked by 1 person

That’s incredible, 4 years is all it took for you to climb to Stage 8 and above. Looks like i’ll have to start taking more leaves out of your book! 🙂

I do find it a tad more difficult to strike a comfortable balance between saving, investing, and living life at the age of 21 whilst im in NS though😂.

LikeLiked by 1 person

Hahahaha when I was 21 all I could think about was partying and stuff, although I was also working part time.

I didn’t do any investing until 2016! So you were already way ahead of me in terms of financial knowledge 🙂

LikeLiked by 1 person

Never too late to start, i believe you are already way ahead of the masses since starting at age 24! Got to admit that i do party every now and then too 😅

I’ve actually just uploaded a new post on my portfolio and financial situation, should you have some free time, please do take a look and I’ll really appreciate any insights or comments you might have for me.

LikeLiked by 1 person

wow >$25k a year in savings.

LikeLike

You forgot to add in contributions from CPF. It’s all included!

LikeLike

To be able to achieve that level of net worth at such a young age is remarkable! You must be doing a lot of right things, look forward to more sharing from you to help the rest of us, 我们加油!

LikeLiked by 1 person

Since it is my net worth, my actual savings are a lot lesser. Yes let’s work hard together!! ^_^

LikeLike

Hi Miss Niao,

Your portfolio is really impressive considering your age and you have just started working only a few years ago. Can you please share with us how did you manage to amass so much savings in such a short period of time?

LikeLike

I was just wondering – how much savings do you think I actually have? And by savings, I mean the actual savings I have in my bank account. The actual number would probably surprise you (in a bad way). :p

The answer is simple, by being my alter ego of Miss Niao! 🙂

LikeLike